The Lindberg & Ripple

Knowledge Base

Read the latest news and insights on investing,

wealth planning, benefits, insurance solutions, and more.

Featured Article

Growth vs. Value: A Market Perspective from DFA

The recent DFA meeting shed light on an important market narrative—one that often gets misinterpreted. While growth stocks have had

AI Investing: The Gold Rush or the Picks and Shovels?

At a recent lunch with investors, the conversation turned to AI ETFs and the parallels to past investment booms.

Stay the Course: Why Reacting to Policy News Can Hurt Your Investments

In today’s fast-moving world, it is easy to get caught up in the latest headlines. A major political announcement can send markets swinging, and…

Estate Planning in 2025: What to Expect and How to Prepare

With the election results in, many are wondering how estate planning strategies might change in 2025. The good news? You can move forward with…

Bringing Estate Planning to Life with Technology

Estate planning is about more than just drafting documents—it’s about ensuring your wealth is distributed exactly as you intend. The challenge…

2024 Markets: A Lesson in Unpredictability

Every year, financial analysts, economists, and asset managers make bold predictions about where the market will head in the next…

Investment Insight: The price you pay for an investment matters more than you think

In the world of investing, the price you pay can make or break your portfolio. This timeless…

Big Changes Could be Ahead in Tax Policy

As we approach 2025, tax policy is shaping up to be a key focus in Washington. With significant provisions of…

Need Access to Funds? Consider a Life Insurance Loan

When thinking about ways to access liquidity during financial emergencies or to fund significant life events, borrowing against the cash value of your…

How to Balance Legacy Planning with Family Needs

As a high-net-worth individual, your financial plan likely extends beyond your personal wealth management. It is also about…

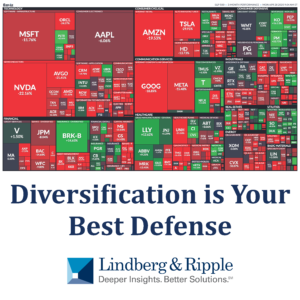

The Importance of Diversification in Today’s Volatile Markets

In an era of increasing market volatility, the concept of diversification remains one of the most important…

Retirement Accounts and Estate Planning: Securing Your Financial Legacy

When it comes to estate planning, trusts are a powerful tool to ensure that your assets are managed and distributed according to…

Revocable vs. Irrevocable Trusts: Key Differences and Their Role in Estate Planning

When it comes to estate planning, trusts are a powerful tool to ensure that your assets are managed and distributed according to…

The Unpredictability of Markets: Why Long-Term Investing is the Key to Success

At Lindberg & Ripple, we often emphasize the importance of a long-term investment strategy. The reason is simple: the stock market is inherently…

Strategic Philanthropy: Maximizing Impact Through Donor-Advised Funds and Private Foundations

At Lindberg & Ripple, we believe that true wealth extends beyond financial success—it’s also about…

Navigating 2024 Legislative Changes: A Guide for High Net Worth Individuals

Each year ushers in legislative and regulatory adjustments that impact key financial planning areas, such as retirement account contribution limits, tax brackets, Roth IRA…

The Importance of Proactive Cash Planning in Today's Financial Landscape

In the ever-evolving financial landscape, cash management has become a critical aspect of wealth preservation and growth. With banks and…

Why Your Business Needs A Strong Employee Retirement Plan To Grow

In today’s competitive business environment, attracting and retaining top talent is paramount. Offering a comprehensive employee benefits package, including a robust retirement plan…

Securing the Future Made Simple: Integrating Life Insurance into Your Financial Plan

In the dynamic world of personal finance, life insurance plays a pivotal role, yet many overlook it due to perceived complexities in the application process.

Safeguarding Your Finances: The Importance of Cybersecurity in Financial Advisory Services

In today’s digital age, where financial transactions and sensitive information are increasingly conducted online, the role of cybersecurity in financial advisory services cannot be overstated.

Harnessing Ingenuity: How Innovation Overcomes Economic Obstacles

In the ever-evolving landscape of the economy, one thing remains constant: the power of human ingenuity to overcome obstacles and drive progress.

Navigating the Risks: Private Equity Investments Amidst Covid and Beyond

In the wake of the Covid-19 pandemic, private equity funds seized opportunities amidst market uncertainties, investing in companies with high valuations.

What the Mass Millionaire’s Tax Means for High-Net-Worth Individuals

A tax increase for those who make over $1 million. But there are ways to reduce the impact.

Incorporating Charitable Giving in Wealth Preservation

Investors with generational wealth to grow and nurture need to ensure they have balanced portfolios that….

Why Is Multigenerational Wealth Management Important?

Investors with generational wealth to grow and nurture need to ensure they have balanced portfolios that….

What Is Wealth Preservation?

Investors with generational wealth to grow and nurture need to ensure they have balanced portfolios that….

How to Leave Behind More Wealth for Future Generations with the Florida Community Property Trust Act

The Florida Community Property Trust Act can help shield your property from capital gains…

How the life insurance industry is evolving to help save lives

What if someone told you there was a life insurance product that not only insured your life, but could also save it? Would you consider that product over others?

How Secure Act 2.0 Will Improve Your Retirement Savings

With the Secure 2.0 Act now signed into law, it’s worth taking some time to understand the provisions that could help boost your retirement prospects.

Carl Peterson meets with Senator Susan Collins

One of the benefits of being a long-time leader in life insurance industry is the opportunity to meet with our elected leaders to discuss trends and the current state…

What Fluctuating Bond Values Mean for Investors

Learn why bond values change, the factors causing recent volatility, and why bonds remain an important part of a balanced investment portfolio.

Carl Peterson presents at the M Financial’s Magnet Summit

M Financial’s 2022 Magnet Summit marked the third year since the launch of the Magnet program in 2019.

Why the “Backdoor” Roth IRA Became a Target of Tax Reform

Learn why the “backdoor” Roth IRA, a popular strategy for some high-wealth investors, became a focus of tax reform efforts.

The Risk of Alternative Investment Options in a Turbulent Market

Learn why some investors look beyond the traditional portfolio mix and toward alternative investment vehicles and why this carries unique risks.

What the Robinhood Controversies Reveal about DIY Retail Investing

Learn about the impact Robinhood and similar retail investment platforms have had on investors, regulators, and the financial markets.

Jay Adkisson

Wed. November 17 | 10am PT Asset protection is commonly used to mitigate the effects of future creditors, lawsuits, and other liabilities. Jay Adkisson, attorney and Managing Partner of Adkisson Pitet LLP, explores current planning trends and how life insurance can be an effective asset protection tool when used within trusts and advanced estate planning […]

Andy Friedman

Wed. November 11 | 10am PT Proposed changes to tax legislation could have significant market and economic impacts. In this special legislative session, Washington insider Andy Friedman discusses what proposed tax changes could mean for retirement investors and small business owners, and offer insights for year-end planning.

Ella Chase

Wed. September 29 | 10am PT Ella Chase, co-founder of Wellth Works and a sixth-generation inheritor within a family enterprise, uniquely understands the advisor-client relationship for HNW women. Ella will discuss tactical tools to improve advisor relationships with clients and their family members so that advisors can “stick with the family,” and she’ll address and […]

The Rise in Securities-Based Lending to Wealthy Investors

Borrowing against a portfolio of stocks and bonds can be a relevant financial & tax strategy, but it is not without risk

Tracy Brower

Wed. August 18 | 10am PT Join sociologist and author Dr. Tracy Brower for an engaging discussion about the future of work, leadership, and engagement and how to best motivate ourselves and employees. Dr. Brower will cover new research, surprising insights, and pragmatic approaches to cultivate and sustain resilience and success through the continuous changes […]

The Potential Tax Risks and Rewards of REITs Under the Biden Administration

Learn why Real Estate Investment Trusts (REITs) could be considered an attractive investment and how proposed tax reforms could impact them.

Making Sense of the Great Inflation Debate of 2021

Learn why some experts fear inflation will reach record highs and what rising rates could mean for investments.

Why Investing in an S&P 500 Index Fund Remains a Popular Option

Learn why Warren Buffet, among other market watchers, advise investing in the S&P 500 index fund over “trendier” stocks.

Bond Investment Myths Amid Interest Rate & Inflation Speculation

Learn why bonds have fallen out of favor among some investors who fear rising interest rates and inflation, and if their concerns are justified.

Andy Friedman

Wed. June 23 | 10am PT Andy Friedman is known for his unique insight and analysis of the political landscape and prospective legislation. He will share his views on proposed tax changes and what this could mean for all facets of the financial industry.

Paul Sullivan

Wed. April 15 | 10am PT Paul Sullivan writes the Wealth Matters column for The New York Times covering issues from private banking and wealth management to philanthropy and inheritance. His articles have appeared in publications such as Fortune, Money, and The Financial Times.

Ian Bremmer

Wed. March 18 | 10am PT Join renowned political scientist Ian Bremmer for a trip around the world in 20 minutes. Ian unpacks the geopolitical landscape and its impact on the U.S. economy, climate issues, cybersecurity, and more. He shares why we should feel optimistic about the post-pandemic recovery, as well as the principal global […]

Lowering a Tax Burden Through Stock Donations

Donating appreciated stocks can provide numerous benefits. Learn how this charitable gift can reduce your tax burden.

Jonathan Godsall

Wed. February 24 | 10am PT Jonathan Godsall provides data-driven insights into how the insurance industry is adapting to meet the expectations of the client of the future. Watch the replay to hear more about the trends reshaping the industry, the changing needs of consumers, and the importance of expanded and enhanced digital capabilities.

Andy Friedman

Wed. February 17 | 10am PT Andy Friedman provides a comprehensive review of the new Washington landscape and its potential effects on taxes and investing.

The 5 Traits of a Top Wealth Management and Investment Advisor

Receiving world-class financial advice relies on specific, crucial professional qualities. Learn what they are:

The Basics of Investment Liquidity

Learn about high and low liquidity levels and what each could mean for your current and future portfolio decisions. Think of assets as ice and money like water, and you’re getting the gist of liquidity.

Paulo Pinho

Wed. January 27 | 10:00 am PT Dr. Paulo Pinho looks at why COVID-19 has caused challenges finding coverage for jumbo cases and older clients. Dr. Pinho discusses co-morbid conditions and how they exacerbate COVID-19, how reinsurers view COVID-19, the keys to success for the vaccines, and what has to happen before things return to […]

The Risks Involved in Maintaining Intergenerational Wealth

A history of wealth is no guarantee that it will survive the next generation. Know the risks to create more durable assets. The greatest wealth transfer in history is afoot. The next decade will see around $68 trillion passed from one…

Are Concentrated Assets More Risk than Reward?

Many wealthy individuals hold concentrated asset positions, but this strategy requires great risk awareness. Concentrated assets rightly set off some alarm bells by challenging the golden rule of diversification.

The Difference Between Restricted and Controlled Stock

Securities can take various forms, and each has certain benefits, drawbacks, details, and applications. Knowing the difference…

Active vs. Passive Investing: The Pros and Cons

How close should an investor’s finger be to the pulse of their assets? As always in wealth management, the answer relies heavily on the individual’s circumstances and preferences alongside some tried and tested practices.

A Look at Income Replacement in Retirement

The things that should end with a career are stress and traffic—income must maintain a steady flow for a comfortable and secure retirement.

Kedra Newsom

Wed. October 28 | 10:00 am PT Kedra Newsom of Boston Consulting Group engaged the M Community in a robust discussion about women’s wealth and the complex needs of HNW and UHNW women. She shared specific strategies for advisors in this market and how the industry is changing to better reach this audience.

Paul Ryan

Wed. October 7 | 10:00 am PT M Financial was honored to welcome Paul Ryan, former Speaker of the U.S. House of Representatives, as our fall Future of Insurance keynote speaker. From his two decades in office to the founding of the nonprofit American Idea Foundation, Paul Ryan’s career has focused on public policy and […]

The Basics of Asset Allocation

Achieving optimal allocation is a key investor goal, but what constitutes “optimal” is a diverse variable not only between individuals but often for the same individual over time…

Ways to Minimize Taxation on Highly Appreciated Assets

Capital gains taxes can take a massive bite out of the returns on highly appreciated assets. Capital gains, of course, are the amount by which…

Carrier Discussion

Wed. September 23 | 10:00 am PT Henry Wong & Tod Nasser – John Hancock & Pacific Life Wondering how the current state of the economy and capital markets are impacting carrier portfolios and investments, and what that means for new business? Tod Nasser of Pacific Life and Henry Wong from John Hancock engaged in a panel discussion […]

The Benefits and Challenges of Estate Equalization

Estate distributions are about more than money and assets—and wealthy individuals may find it difficult to form a long-term strategy that’s fair to everyone.

Don Delf

Wed. September 9 | 10:00 am PT Don Delf, Private Wealth Advisory Leader for PwC US, brought his legacy and expertise in private wealth to answer the trillion-dollar question: What’s top of mind for business owners and family offices heading into elections and uncertainty? Don also explored how elasticity of exemptions is critical in the […]

Dynasty Trusts and Multi-Generational Planning Can Help Future-Proof Wealth

It’s a sad reality that estrangement and divorce can sour relationships with loved ones and impact family wealth. Taxes can also significantly impact…

Tony Arnerich

Wed. August 12 | 10:00 am PT Multi-Impact Asset Management in the Current Economy Tony Arnerich explored current trends related to ESG (environmental, social, governance) investing, intentional investing, and wealth transfer to the next generation. He demonstrated how the pandemic has created opportunities for environmentally and socially responsible investing and the implications to your clients’ […]

Scott Clemons

Wed. July 29 | 10:00 am PT Investing in the Wake of a Pandemic Scott Clemons, Chief Investment Strategist for Brown Brothers Harriman, examined the data around the pandemic’s effects on the economy. He also discussed the impact for insurance companies managing large amounts of money, what it means for your clients’ portfolios, and the […]

Zanny Beddoes

Wed. July 15 | 10:00 am PT Our Global Economy in the Post-Pandemic World KEYNOTE SPEAKER: Zanny Minton Beddoes – The Economist Named one of the Most Powerful Women in the World by Forbes, Zanny Minton Beddoes is a leading voice at the intersection of economics and policy. Known for delivering sophisticated insight on all facets of […]

Financial Planning for a Longer Life

People are living longer, leaving many with more time than money. Learn why this can be a double-edged sword for the wealthy…

Marc Cadin and Armstrong Robinson

Wed. June 24 | 12:30 PT COVID = Accelerant for Change AALU/GAMA’s Marc Cadin and Armstrong Robinson examined developing political trends and what financial professionals should expect through election day. They also explored the long-term impact of recent regulatory and legislative actions and identified the top opportunities and threats these regulations will generate for financial […]

Marc-Andre Giguere

Wed. June 17 | 11:00 am PT What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current market conditions? Marc-Andre Giguere discussed possible ripple effects […]

Doug French

Wed. June 3 | 10:00 am PT Beyond COVID 19 – How the insurance industry will reimagine their business. Doug French, Ernst & Young’s Managing Principal of Insurance & Actuarial Services, examined the current economic disruption, its impact on the global insurance marketplace, and the effects on wealth transfer for the UHNW client, followed by […]

Colin Devine

Wed. June 3 | 10:00 am PT Outlook for the U.S. Life Insurance Industry After COVID-19 Colin Devine, Principal of C. Devine & Associates, examined the current status of the U.S. life insurance industry and how life insurers are doing amid COVID-19. Colin offers deep insights into what to expect in the coming months, the new […]

Dr. Quincy Krosby

Wed. May 6 | 10:00 am PT Of the Moment Market Outlook Dr. Quincy Krosby, Prudential’s Chief Market Strategist, discussed how the pandemic is impacting financial markets and the overall economy. Dr. Krosby explored the recent and rapid shift in consumer behavior and the emergence of new technologies for navigating the current landscape, and she […]

Jeff Bush

Wed. April 22 | 9:30 am PT An Overview of the Political Environment, Prospective Legislation, and Strategies for Investment and Retirement Planning Jeff Bush and Andy Friedman have collaborated on a 2020 presentation that addresses all of the issues brought about by the recent coronavirus pandemic. In his April 22 presentation, Jeff explored the details […]

Retirement Planning by the Numbers

Retirement planning offers many options for peace of mind. Spotlighting the 401(k), 403(b), and 457(f) and how a plan manager can help. 401(k)s, 403(b)s, and 457(f)s are vital tools for retirement planners. Some plans are…

Be Dedicated to Your Clients and Everything Will Fall into Place

Michael Silverberg is a Senior Advisor at Lindberg & Ripple. Listen to him speak on the M Financial Podcast “Inside Voices: Be Dedicated to Your Clients and Everything will Fall into Place.”

The Generation-Skipping Tax Exemption and Maximizing Wealth Preservation

It’s important to understand the GST tax (Generation-Skipping Transfer tax) in the context of the Tax Cuts and Jobs Act (TCJA). Since it’s passing, the TCJA has led to significant changes…

Should You Consider Private Placement Life Insurance?

The secret to investing in alternative investments without a supersized tax bite Private Placement Life Insurance (PPLI) products are fast becoming the strategy…

Estate Planning Opportunities with the TCJA: Gift Tax Exemptions

People with large estates have an unprecedented – but temporary – opportunity to transfer a substantial amount of wealth to their loved ones without incurring transfer taxes. Lindberg & Ripple reveals why families should take advantage of these higher gift tax limits now for estate planning.

Various Investment Options Defer Tax and Generate More Potential Income

“Time is money” is a neat summation of tax-deferred investment accounts. Discover how to generate these savings and why the longer investors wait, the better. Taxes are typically inevitable. However, there are ways to delay the inevitable and accumulate more significant wealth in the process.

Investors: A World of Diversification Benefits is Waiting

Why a globally-diversified portfolio can help you weather the short-term ups and downs of investing. Nobel Prize-winning economist Harry Markowitz famously called diversification the only “free lunch” in finance.